The global dye sublimation printing market size was estimated at $14.9 billion (USD) in 2024 and is projected to grow at a CAGR of 11.3% from now to 2030, Grand View Research forecasts. The market is experiencing strong growth, fueled by the rising demand for customized apparel and promotional merchandise, particularly from small businesses and e-commerce platforms. The rapid adoption of dye sublimation technologies in textile manufacturing, especially across the Asia Pacific region, is significantly expanding the industry’s footprint. Additionally, the ongoing shift toward eco-friendly, waterless printing solutions is further accelerating market adoption. The development of hybrid printing technologies, incorporating dye sublimation with DTG and UV methods, is driving innovation and enabling new business models.

To learn more about this report, request a free sample copy.

To learn more about this report, request a free sample copy.

The rising demand for customized apparel and merchandise is a key driver for the dye sublimation printing market. As consumers increasingly seek personalized clothing for individual expression, sports, or promotional purposes, businesses are turning to technologies such as dye sublimation to meet this need. Dye sublimation offers high-quality, durable prints on polyester fabrics, making it ideal for customized t-shirts, sportswear, and other merchandise. According to the India Brand Equity Foundation, the global apparel market is expected to grow at a CAGR of 8%, reaching USD 2.37 trillion by 2030. This growth, along with the expansion of textile exports from countries including India, is driving demand for customized products. As consumer preference for on-demand, personalized items rises, the need for dye sublimation printing will continue to grow, thereby contributing significantly to market growth.

Asia-Pacific’s textile manufacturing sector is experiencing rapid advancements, directly fueling the growth of the dye sublimation printing market. China, the world’s largest textile manufacturer, holds over 41% of global textile and apparel exports. This massive production base is increasingly adopting digital printing technologies, including dye sublimation, to meet the rising demand for customized and on-demand apparel. Similarly, Vietnam and Bangladesh are emerging as key players, with Vietnam becoming the third-largest exporter of textiles and apparel globally and Bangladesh holding the second-largest position. Both countries, along with China, are increasingly adopting digital printing technologies, including dye sublimation, to meet the rising demand for customized and on-demand apparel.

The textile industry is increasingly focusing on sustainable production methods to reduce environmental impact. In February 2025, Mimaki Engineering Co., Ltd. launched the Tx330-1800 and Tx330-1800B printers, designed to minimize water usage and eliminate the need for extensive pre- and post-processing. These printers offer high-quality results with the ability to switch between textile pigment and dye sublimation inks, making them more versatile and eco-friendly. This shift towards waterless and efficient printing is driving the adoption of dye sublimation technology, supporting more sustainable and on-demand textile manufacturing.

The integration of dye sublimation with direct-to-garment (DTG) and UV (Ultraviolet) technologies in hybrid systems presents a significant opportunity for businesses to meet the growing demand for customized products. This hybrid system allows for printing on a wide range of materials: dye sublimation works best with polyester, DTG is ideal for cotton, and UV technology can print on hard surfaces such as wood or metal. This versatility helps businesses produce high-quality, personalized items more efficiently while also reducing waste. As the demand for eco-friendly and on-demand products rises, this integration offers a competitive edge in the market.

Dye sublimation is most effective on polyester or polyester-blend fabrics, as the ink bonds with the synthetic fibers at a molecular level when exposed to heat. However, it is challenging to use on natural fibers such as cotton, linen, or wool, which do not react well to the sublimation process. This creates limitations for businesses trying to meet demand for products made from natural fibers. As consumers increasingly prefer eco-friendly, natural materials, this challenge becomes more pronounced.

Product Type Insights

The inks & consumables segment accounted for the largest share of 41.9% in 2024, due to the increasing demand for high-quality, on-demand, and customized printing. The growing adoption of digital printing technologies in textile and promotional product markets is a key factor behind this demand. Additionally, advancements in ink formulations, including eco-friendly options and faster drying times, are further fueling market growth. In August 2024, Prism Inks announced the launch of FUZION Ink Technology at Printing United. This patented innovation enables seamless integration across multiple printing methods, excelling in both Direct-to-Film (DTF) and Sublimation Printing. FUZION Ink allows printers to handle various materials, including polyester, cotton, and hard surfaces, using a single printer

The printers segment is expected to grow at a fastest CAGR from 2025 to 2030. Factors such as the increasing adoption of digital printing solutions in textile and apparel manufacturing and, rise of on-demand printing for customized products, coupled with advancements in printer technologies that enhance speed, efficiency, and color accuracy, are propelling the segment growth. Additionally, the growing demand for wide-format and industrial printers in sectors such as signage, sportswear, and promotional products will continue to fuel market expansion.

Printing Technique Insights

The transfer dye sublimation printing segment accounted for the largest share in 2024, driven by its high efficiency and quality in applications such as sportswear, fashion, and promotional textiles. This printing technique’s ability to produce durable, vibrant designs on polyester and polyester-blend fabrics is a key factor in its dominance. Additionally, its low environmental impact due to the use of waterless printing technology and minimal waste further contributes to its widespread adoption, especially as demand for sustainable manufacturing increases.

The direct-to-fabric (D2F) segment is expected to grow at a significant CAGR during the forecast period. D2F technology’s ability to print directly onto fabric without the need for transfer paper reduces material waste and increases production efficiency. This makes it particularly attractive for custom textile manufacturers and businesses offering personalized apparel. Factors such as the rising demand for on-demand, short-run textile production, especially in the fashion and home decor sectors, are further contributing to the growth of this segment. Additionally, D2F’s quick turnaround times and ability to handle diverse fabric types make it highly relevant to the evolving needs of the textile industry.

Application Insights

The textile & apparel printing segment accounted for the largest share in 2024, driven by the increasing demand for customized, on-demand products in the fashion, sportswear, and apparel industries. The shift towards digital printing technologies in textile manufacturing has boosted this trend, with consumers increasingly seeking personalized designs and faster turnaround times. Companies in the market are increasingly focusing on enhancing productivity and expanding application versatility through printer innovations. In September 2022, Epson announced the launch of two new SureColor dye sublimation textile printers. The SureColor SC-F6400 (4-color) and SC-F6400H (6-color) are designed for low to medium-volume printing applications such as textile production, personalized products, and high-end photo reproduction.

The soft signage segment is expected to register a notable CAGR from 2025 to 2030. Factors such as the increasing demand for lightweight, foldable, and reusable display materials in retail, exhibitions, and trade shows, rising adoption of polyester-based fabrics over traditional PVC for sustainability, and the need for vibrant, high-resolution graphics are driving growth. Companies are introducing advanced printing solutions tailored for wide-format, high-speed production to meet the rising demand for soft signage. For instance, in June 2021, Agfa launched the Avinci CX3200, a dye-sublimation roll-to-roll printer capable of printing directly to textile or on transfer paper. Designed for soft signage applications, it supports print widths up to 3.2 meters and production speeds of up to 270 m²/h. The printer uses eco-friendly, odorless water-based inks and ensures vibrant quality across various polyester-based fabrics, making it ideal for banners, trade show displays, and flags.

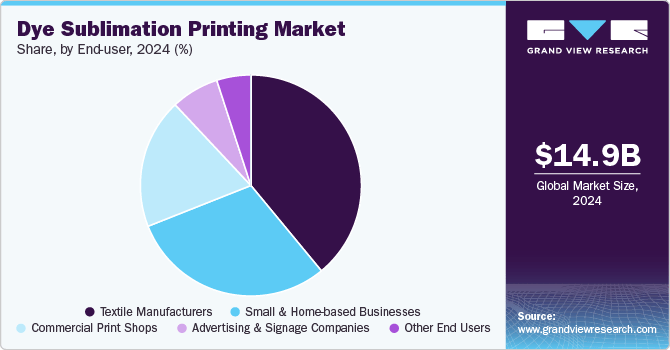

End-user Insights

The textile manufacturers segment accounted for the largest share in 2024. Factors such as the increasing demand for high-speed and high-volume textile production, rising consumer preference for customized apparel, and the shift toward eco-friendly, digital dye-sublimation processes are driving this growth. Companies in the market are increasingly focusing on high-volume, precision-driven solutions to support the evolving needs of textile manufacturers. In May 2024, Epson announced the launch of the 76-inch SureColor SC-F11000 and SC-F11000H industrial dye-sublimation printers for textile manufacturers. It is designed to deliver rapid, reliable, and high-quality output. The SC-F11000H features an optional Jumbo Roll for uninterrupted production, making it ideal for large-scale textile manufacturing.

The small and home-based businesses segment is expected to register a notable CAGR from 2025 to 2030. Small & home-based businesses segment includes individuals or small-scale entrepreneurs who operate printing businesses from home or small workshops, often focusing on personalized products. Factors such as the rising popularity of personalized merchandise, increasing accessibility of compact and affordable dye sublimation printers, growth of online platforms including Redbubble, Etsy, and Shopify, expanding side-hustle culture, and the availability of user-friendly design software and plug-and-play printing systems are supporting the segment growth during the forecast period.

Regional Insights

The Asia Pacific dye sublimation printing market accounted for 36.5% of the global share in 2024, driven by factors such as the rapid growth of the textile and apparel sector, rising demand for personalized and on-demand printing, and the expansion of e-commerce platforms. Key drivers include the increasing adoption of digital printing technologies for custom apparel and home decor, the growth of the fashion industry in countries such as India and Vietnam, the surge in demand for high-quality promotional products, and advancements in printing equipment that enable faster production speeds and improved print quality.

Countries such as Vietnam, India, Japan, and China are emerging as key players in the global textile sector. According to the Vietnam Textile and Apparel Association, Vietnam’s textile exports reached USD 44 billion in 2023, with the US as its largest market. Additionally, according to the India Brand Equity Foundation, the India’s textile market is projected to grow at a 10% CAGR to USD 350 billion by 2030, with exports expected to reach USD 100 billion. China, the world’s largest textile exporter, also saw textile and garment exports rise to USD 293.6 billion in 2023. The rapid growth in textile manufacturing in these countries is driving the demand for advanced printing technologies, including dye sublimation, as businesses aim to meet the growing need for customized and personalized textile products.

North America Dye Sublimation Printing Market Trends

The North American dye sublimation printing market in 2024 is primarily driven by the rising demand for customized textiles, the growth of e-commerce, and the shift toward sustainable production methods. As consumers demand personalized products, manufacturers are turning to advanced technologies, including dye sublimation, for high-quality, on-demand fashion. Additionally, faster production timelines and eco-friendly alternatives are boosting adoption. The U.S. textile sector’s investments in technology further support this trend, while Mexico’s competitive production costs and skilled workforce contribute to regional textile manufacturing growth. Furthermore, expanding applications in signboard printing, promotional product printing, home decor, and photo & art printing are further fueling the region’s growing demand for dye sublimation printing technologies.

The U.S. dye sublimation printing industry held a dominant position in 2024. The dye sublimation printing market in the U.S. is witnessing significant transformation, driven by increasing demand for personalized and on-demand apparel, the growth of e-commerce retail, and the shift toward localizing textile production to improve speed and supply chain reliability. According to the U.S. Census Bureau, clothing and accessories retail sales surged to USD 25.3 billion in October 2024, up from USD 15.9 billion in January 2022. As consumer expectations shift toward speed and personalization, dye sublimation printing is emerging as a vital tool for brands to stay competitive and meet market demands effectively.

Key Dye Sublimation Printing Company Insights

Some of the key players operating in the market include Seiko Epson Corporation, Mimaki Engineering Co., Ltd., Roland DG Corporation, HP Inc., and Sawgrass Technologies, Inc.

- Founded in 1942 and headquartered in Nagano, Japan, Seiko Epson Corporation is a prominent manufacturer of printing and imaging equipment. The company specializes in dye sublimation printing through its extensive portfolio of high-performance printers used in textile, signage, and industrial printing applications. Epson’s dye sublimation solutions are known for their precision, speed, and energy efficiency. The company leverages its proprietary PrecisionCore technology and eco-friendly innovations to support sustainable and on-demand printing.

- Founded in 1975 and headquartered in Nagano, Japan, Mimaki Engineering Co., Ltd. is a provider of industrial inkjet printers and cutting plotters. The company is a key player in the dye sublimation printing space, offering a wide range of textile printers designed for apparel, sportswear, and soft signage. Mimaki is known for its advanced printhead technology, high-resolution output, and eco-conscious ink systems.

Key Dye Sublimation Printing Companies:

The following are the leading companies in the dye sublimation printing market. These companies collectively hold the largest market share and dictate industry trends.

- Seiko Epson Corporation

- Mimaki Engineering Co., Ltd.

- Roland DG Corporation

- HP Inc.

- Sawgrass Technologies, Inc.

- Kornit Digital Ltd.

- Durst Group Ag

- Ricoh Company, Ltd.

- Dover Industries Italy S.r.l

- Mutoh Industries Ltd.

Recent Developments

- In October 2024, Canon Europe launched the SELPHY QX20, a portable dye-sublimation photo printer and successor to the QX10. It supports both 2:3 and square formats, catering to social media-savvy users. QX20 is available in terracotta red, dark grey, and white, offering greater versatility for on-the-go photo printing.

- In August 2024, Epson launched the 64-inch SureColor F9570 and F9570H dye-sublimation printers. Featuring a compact design and expanded ink set, they deliver high-quality output on textiles and hard goods. Replacing the F9470 models, they are built for 24/7 productivity.

- In July 2024, Epson launched the SureColor F9500 and SC-F9500H, two advanced 64-inch dye-sublimation printers designed to replace the F9400 series. These new models feature a compact, low-profile design for space efficiency, along with improved productivity, usability, and image quality.

- In April 2024, Epson introduced the SureColor F11070 and F11070H, two high-performance industrial dye-sublimation printers built for continuous, cost-efficient textile production. Designed for high-volume print shops, these models feature optional large roll media unwinders and, in the F11070H, an expanded ink set. In June 2023, Konica Minolta announced the AccurioTex 700, its first dye-sublimation printer. Featuring 16 variable drop size printheads and CMYK inks, the 2m transfer paper printer delivers print speeds up to 190 sqm/hr in draft mode.

Dye Sublimation Printing Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 16.4 billion |

| Revenue Forecast in 2030 | USD 28.0 billion |

| Growth rate | CAGR of 11.3% from 2025 to 2030 |

| Base year for estimation | 2024 |

| Historical data | 2018 – 2023 |

| Forecast period | 2025 – 2030 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2030 |

| Report coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Segments covered | Product type, printing technique, application, end-user, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

| Key companies profiled | Seiko Epson Corporation; Mimaki Engineering Co. Ltd.; Roland DG Corporation; HP Inc.; Sawgrass Technologies, Inc.; Kornit Digital Ltd.; Durst Group Ag; Ricoh Company Ltd.; Dover Industries Italy S.r.l; Mutoh Industries Ltd. |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |