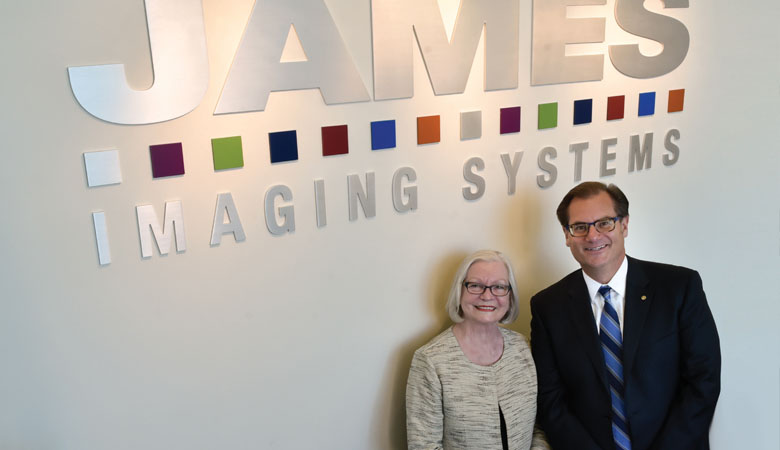

Above: James Imaging Systems Brookfield, Wisconsin, headquarters.

From its humble basement beginnings, the company has grown to become the second-largest officer technology dealership in its market.

The story of James Imaging Systems, an office technology dealership founded in a basement in Waukesha, Wisconsin, in 1977, is familiar to many other dealers who launched their businesses in a similar fashion. When James G. Tegeder founded the company with his wife Lola, it was called James Office Equipment and sold the standard fare of the day, copiers, typewriters, duplicating machines, and fax machines.

Within five years, the company had built a book of business that enabled it to move out of the Tegeder’s basement. After James’ sudden death in 1984, Lola took over the business and four years later brought in sons Thomas (Tom) and Patrick. Tom remains with the dealership, serving as president after acquiring his brother’s ownership interest, while Lola continues to serve as chairman of the board and chief executive officer, cementing its status as a woman-owned business.

Lola and Tom Tegeder.

The amazing thing about Lola is that she is still as active in the business today as she was when the business began. “She says it keeps her young and her mind active,” said Tom. “She likes the detail, and fixing up the branch offices and making sure this office is pristine as a monument to my dad. The types of things that I don’t like to do, she likes to do. And the things that she doesn’t like to do, I like to do. We complement each other pretty well.”

Since 2000, the company has been headquartered in Brookfield, Wisconsin, and has grown to become the second-largest independent dealer in its market. In 2005, James Office Equipment was renamed James Imaging Systems, to better reflect its digital imaging offerings.

That’s how James Imaging Systems began, now let’s dig deeper into where it is today.

Service and Solutions

Customers like doing business with James Imaging Systems because of the service experience they receive and the overall customer care. “We have good relationships with our long-term clients,” said Tom. “They’re very comfortable doing business with us. The billing is accurate, meters are read on time, service is very good, and our techs are well trained. They know what they’re doing, right down to our delivery drivers.”

James Imaging Systems’ lobby.

Tom takes pride in the company’s ability to make the right hires and then pay them a little more than the going rate. That’s paid off. “That’s typically the first experience the client has with the company if they’re new to us,” said Tom. “We try to make it an exceptional experience, if possible.”

Unlike other dealers who are moving into managed IT, that’s not on James Imaging Systems’ current agenda. Instead, the focus is solutions. Its leading solution is DocuWare, which James Imaging Systems uses to differentiate itself from just talking about the copier. The dealership is a DocuWare Diamond Club member, an honor that acknowledges its success selling the DocuWare solution.

“We talk about their workflow,” said Tom. “With labor being constrained nowadays, companies are trying to do more with less. We can use DocuWare to do that. We can automate their processes, and then, of course, take care of their scanning and printing needs.” The dealership has eight people who specialize in DocuWare, including five software engineers who do the programming and setup, two dedicated salespeople, and a director.

James Imaging Systems also has a DocuWare connector into the SAP ERP system, which is exclusive to the company as a DocuWare dealer. The dealership is also the exclusive distributor in North America for the connector. Because of that, it subcontracts some work for Ricoh’s and Toshiba’s direction operations, Flex Technology Group, and RJ Young. “It’s taken off more than we thought it would,” said Tom.

Document solutions are growing by about 20% a year. Other areas growing nicely include managed print services, production print, and wide format.

The bulk of the business is focused on up and down-the-street accounts, although the dealership does have some major and mid-level accounts, or as Tom describes them, “mini-majors.” James Imaging Systems is also strong in certain vertical markets, including banking, energy, healthcare, and its top vertical, manufacturing.

Digital Imaging

Even though James Imaging Systems has a strong solutions focus, one can’t ignore the imaging technology that it currently sells. The company began as a Mita dealer and partnered with Toshiba in 1982 after Mita added three more dealers in the same market, disrupting the exclusivity James Imaging Systems had in the market. Besides Toshiba, James Imaging Systems sells Konica Minolta, HP, Kyocera, and Lexmark. The dealership first sold Konica Minolta’s color A3 MFPs, then moved into color production, and eventually took on the full line of Konica Minolta products. Kyocera represents its primary A4 offering, followed by HP and Lexmark.

While diversification is currently a big talking point in the document imaging industry, that’s not as big of a priority at James Imaging Systems. “We’re looking at how we grow organically,” said Tom. “That’s our focus. We think there’s a lot of growth within our current client base with solutions and MPS. And we’re trying to get really good, really good at that.”

That said, he is looking closely at Toshiba’s line of barcode printers to see if those products would be a good fit.

Acquisitions

James Imaging Systems is no stranger to acquisitions, having made a total of 11 across the history of the dealership. The most recent were two Konica Minolta dealers acquired during the pandemic. Looking to expand into northeast Wisconsin, Tom met with Rick Taylor, Konica Minolta’s president and CEO at the time, and learned that Konica Minolta was looking to consolidate distribution, which meant Tom would have to buy a dealer that was authorized to sell Konica Minolta in that region. Three dealers were available, and Tom acquired two of them, while the other was acquired by a large dealership out of Chicago.

That was the most recent acquisition, and Tom somewhat fondly recalls the first. It was a Toshiba dealer that he described as “a thorn in our side.” The owner was getting up there in age and had no one to take over the business, so he was looking to sell. The acquisition might not have happened except for a backorder situation with Toshiba toner.

“We got wind that the toner was going on backorder, so we ordered up and had excess stock,” recalled Tom. Apparently, this “thorn in James Imaging Systems’ side” found out that James Imaging Systems had excess toner and called looking to buy some. James Imaging Systems’ vice president at the time turned him down, but after Tom thought, what does he tell his customers? That we had the toner and wouldn’t sell it to him? Ultimately, he reached out to the dealer. “From a publicity standpoint, we were going to get further down the road selling him the toner,” remembered Tom.

When Tom offered to drop off the toner, this competitor invited him to lunch. They worked on the deal at lunch, and then Tom brought in the consulting firm of Strategic Business Associates to negotiate the acquisition. “They had a good market share a little bit to the north of us and a good reputation for service,” observed Tom about the dealership he was acquiring. “They had a salesperson who had been there forever and really good service techs. We knocked a competitor that was giving us a hard time out in the field, so it was both offensive and defensive.”

After that, James Imaging Systems started looking for smaller dealers that were in its marketplace with a good concentration of business. “What we learned from these acquisitions, and I don’t think I’m a stranger to it, but you get some really great people who have been there a long time that understand the industry,” said Tom.

An Eye to the Future

After starting with just two employees in 1977, James Imaging Systems currently has 105 and has been growing nicely, especially this year now that it is almost completely caught up on backorders. It’s on pace to hit $37 million for the year. As a result, Tom and the rest of the James Digital Imaging team have high aspirations for the future.

“Realistically, I think we could double to $75 to $80 million,” he said. “That’s kind of our long-term goal. Years ago, our goal was getting to $30 million, which we thought was out of reach when we were at $12 million. Now that we’re at $37 million, anything is possible.”

.jpg)